[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”20px” padding_right=”” padding_bottom=”20px” padding_left=”” type=”legacy”][fusion_builder_row][fusion_builder_column type=”3_5″ layout=”3_5″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”false” border_sizes_top=”0″ border_sizes_bottom=”0″ border_sizes_left=”0″ border_sizes_right=”0″ first=”true” spacing_right=””][fusion_text]

We know that an integrated approach provides better outcomes for clients. Our integrated service offering is provided by the Navwealth Accounting, Wealth, Lending and Business Consulting teams. These teams include specialists in their chosen field who work collaboratively across the business to ensure optimal results for Navwealth clients.

Please see below a detailed description of each teams offering and services:[/fusion_text][/fusion_builder_column][fusion_builder_column type=”2_5″ layout=”2_5″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”true” border_sizes_top=”0″ border_sizes_bottom=”0″ border_sizes_left=”0″ border_sizes_right=”0″ first=”false”][fusion_text]![]() [/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”yes” overflow=”visible” type=”legacy”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” align_self=”flex-start” border_sizes_undefined=”” first=”true” last=”true” hover_type=”none” link=”” border_position=”all”][fusion_tabs design=”classic” layout=”horizontal” justified=”yes” backgroundcolor=”#ffffff” inactivecolor=”#cee5ef” bordercolor=”#1d4c81″ icon=”” icon_position=”” icon_size=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””][fusion_tab title=”Wealth Management” icon=””]

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”yes” overflow=”visible” type=”legacy”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” align_self=”flex-start” border_sizes_undefined=”” first=”true” last=”true” hover_type=”none” link=”” border_position=”all”][fusion_tabs design=”classic” layout=”horizontal” justified=”yes” backgroundcolor=”#ffffff” inactivecolor=”#cee5ef” bordercolor=”#1d4c81″ icon=”” icon_position=”” icon_size=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””][fusion_tab title=”Wealth Management” icon=””]

We know that you work hard for the money you earn and want the best possible life for you and your family. To achieve this, you need to ensure that the money you have also works hard for you. A financial plan based on your specific circumstances, goals and dreams can ensure you minimise any financial pressures and that you improve your overall lifestyle now and into the future.

Our ‘Values Based’ approach creates a plan which reflects your life’s goals and ensures all parties remain focused and motivated towards achieving the desired outcome. This plan encompasses your wealth creation, accumulation, debt reduction and asset protection strategies and includes a combination of our wealth management services.

You can feel comfortable that all aspects of your situation have been considered and a personalised plan has been put in place to meet your specific needs and goals. You can also enjoy the ease of having just one contact point for all of your financial needs, saving you precious time.

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_3″ spacing=”yes” last=”no” center_content=”no” hide_on_mobile=”no”]

[fusion_text]Our Wealth services include:

- Wealth Creation Advice

- Investment Advice

- Superannuation Planning

- Retirement Planning

- Estate Planning *

- Personal and Business Insurance

- Lending

- Share Advice and Broking *

- Self-Managed Super Fund (SMSF)

- Aged Care Planning (see separate page)

* These services are outsourced to our professional partners in an integrated approach with Navwealth[/fusion_text]

[/fusion_builder_column_inner]

[fusion_builder_column_inner type=”2_3″ spacing=”yes” last=”yes” center_content=”no” hide_on_mobile=”no”]

[fusion_text][spacer height=”4px”]

Click image to View/Download Navwealth

Wealth Management Brochure

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner]

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner]

[fusion_builder_column_inner type=”1_1″ spacing=”yes” last=”yes” center_content=”yes” hide_on_mobile=”no”]

[/fusion_builder_column_inner]

significant and positive impact on their financial future

Craig Banning, Navwealth Director

[spacer height=”10px”][/fusion_tab][fusion_tab title=”Accounting” icon=””]

Accounting and taxation services for individuals and businesses are an integral part of the Navwealth offering.

We believe wholeheartedly in a collaborative approach to your financial requirements to achieve efficiency and most importantly success. Our qualified and experienced staff work with our clients to provide comprehensive tax compliance and accounting advisory services.

The role of a modern Accounting business is much more than preparing statutory returns, reports and declarations.The modern accountant should work as a team with you and your other professional advisers in looking to maximise your financial and taxation opportunities and outcomes. The result is that decisions are made based on an entire set of financial circumstances not just those relating to a professionals skills and expertise.

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ spacing=”yes” last=”no” center_content=”no” hide_on_mobile=”no”]

[fusion_text]Our accounting services include:

-

- Accounts – Financial statements preparation

- Tax – Income tax, FBT, CGT, R&D, 221D,BAS and IAS returns

- Reporting – Payroll tax, workers comp and land tax

- Corporate Secretarial – ASIC, incorporations and registered office

- Advice – Tax planning, salary packaging, structures and international tax matters

- Reviews – ATO and regulatory body audits, reviews and representations

- Bookkeeping – Platforms, data capture and management accounts

- Super – Self Managed Super compliance

[/fusion_builder_column_inner]

[fusion_builder_column_inner type=”1_2″ spacing=”yes” last=”yes” center_content=”no” hide_on_mobile=”no”]

[fusion_text][spacer height=”4px”]

Click image to View/Download Navwealth

Accountancy & Tax Brochure

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner]

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner]

Michael Kirby, Navwealth Client

[spacer height=”10px”]

[spacer height=”10px”][/fusion_tab][fusion_tab title=”Lending” icon=””]

Effective mortgage and debt management is essential to financial well-being. Arranging a loan is easy. Ensuring it is the right loan and that it is structured in the optimal manner for your individual circumstances is where being a Navwealth client makes a difference.

The Navwealth lending team has experience across residential, commercial and leasing finance and is committed to providing strategic advice to clients. Our lending division has vast experience in residential and commercial lending and will work to understand your individual situation, your overall financing goals and how best to achieve them.

Navwealth Lending is part of an integrated approach to your financial needs

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ spacing=”yes” last=”no” center_content=”no” hide_on_mobile=”no” class=”column-right-padding”]

[fusion_text]Our Lending Services include:

- Residential loans

- Investment loans

- Commercial loans

- Business finance

- Motor vehicle finance

- Commercial fitouts

- Loan comparison and assessment

- Buyers agent services

[/fusion_text]

[/fusion_builder_column_inner]

[fusion_builder_column_inner type=”1_2″ spacing=”yes” last=”yes” center_content=”no” hide_on_mobile=”no”]

[/fusion_builder_column_inner][/fusion_builder_row_inner]

T Cameron, Navwealth Client

[spacer height=”10px”][/fusion_tab][fusion_tab title=”Business Consulting” icon=””]

Build a high performance, profitable, valuable, and overall successful business with Navwealth Business Consulting.

Owning and running your own business, regardless of size, can be extremely rewarding, however it is imperative to understand, and more importantly overcome the many challenges and obstacles that will be faced.

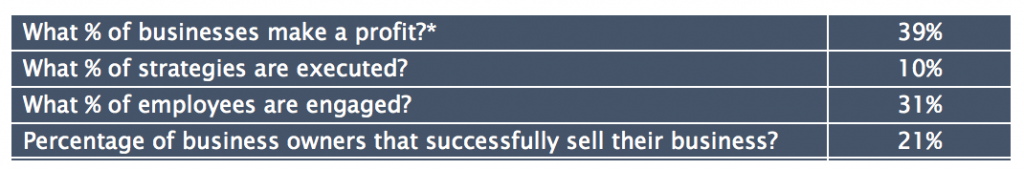

Did you know, market research statistics indicate that most small to medium sized businesses fail to build a successful business or implement even basic best practice strategies.

‘Coaching’ or in this case business consulting ensures your business is maximising opportunities for success, by ensuring that all aspects of your business are performing at their optimal levels.

Navwealth Business Consulting takes your business success personally. We take time to understand you and your business and develop strategies required to achieve your short and long-term business and personal objectives.

Our Business Consulting services include:

-

- Business Discover – it is time to ‘Clean The Cupboard’

- Business Success Program – planning for ultimate success

[spacer height=”10px”][/fusion_tab][fusion_tab title=”Aged Care Advice” icon=””]

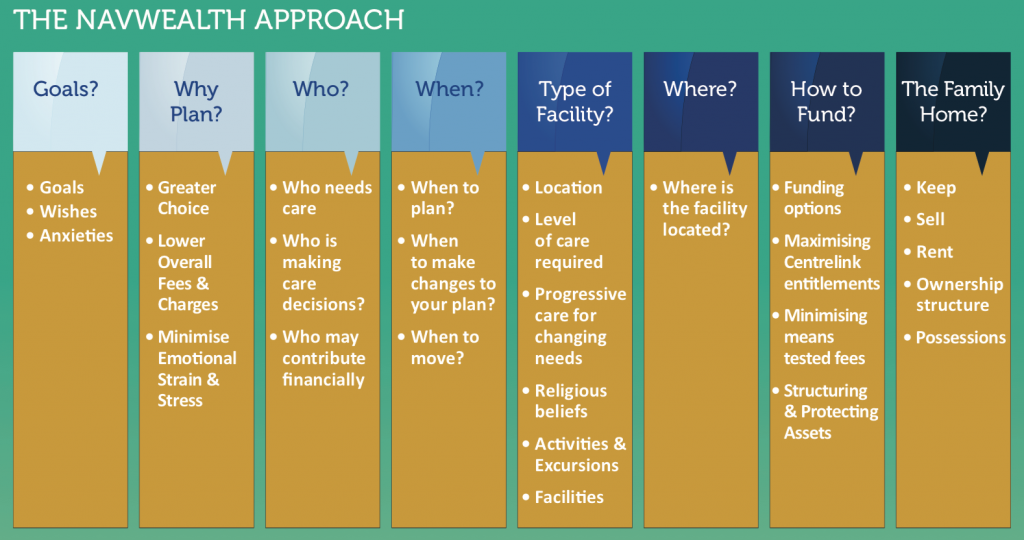

As Australia’s population continues to age, we are witnessing an ever increasing demand on Aged Care Facilities leading to increased costs.

Having money does not guarantee a preferred choice of care and failing to plan can cause great emotional and financial strain on entire families.

Navwealth take the time to understand you and your family’s needs, wishes and financial situation to guide you through the emotional rollercoaster of moving to Aged Care.

We offer various levels of services aimed at assisting the Aged Care journey for yourself or a loved one.

We will determine the services you need and the areas where we can be of most assistance. We will then assist you in making informed smart choices about moving to an Aged Care facility and advise how best to reduce your costs and preserve your financial assets.

It is always a good idea to have a discussion about aged care from age 70 as there are many things that can be done to help reduce future aged care costs and the more time there is to plan these changes the better! We also offer help for in home care.

We have published a series of articles relating to Aged Care aimed at providing important information to those seeking Aged Care Advice. We will continue to add to this list as we have more articles available. Please click on the link below to read articles in full.

- AGED CARE – All you need to know

- Home Care, Retirement Village or Aged Care Facility?

- Aged Care Assessment and Facilities Review

- Minimising Aged Care Costs

- It’s all about Cash Flow

NAVWEALTH AGED CARE BROCHURECLICK HERE or on the image to download a copy of the Navwealth Aged Care Brochure |

NAVWEALTH AGED CARE eBOOK We have published an eBook, A Guide to Planning Aged Care, which outlines the key considerations when looking into Aged Care for yourself or a loved one. To request a copy to be emailed to you, please CLICK HERE or on the image

|

[spacer height=”10px”][/fusion_tab][fusion_tab title=”Bookkeeping Resources” icon=””]

Navwealth Bookkeeping Resources was established to give you back the most precious of resources: TIME.

We know from experience that a successful partnership between bookkeeping and accounting contributes to the long-term financial success of any business. We want your business to grow and we want to be part of that growth.

Regardless of your business size our experienced team has the skills and resources to service all your bookkeeping needs in a timely efficient manner.

Our goal is simple. It’s all about TIME. Time that we want to give back to you.

[fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ spacing=”yes” last=”no” center_content=”no” hide_on_mobile=”no” class=”column-right-padding”]

[fusion_text]Navwealth Bookkeeping Resources designs service packages to suit your needs, your business and your budget.

Our Bookkeeping services include:

- Data entry and bank reconciliations

- Reporting for management

- BAS and GST

- Payroll Processing and Single Touch Payroll

- Cash flow management and reporting

- Accounting software training

- More….

CLICK HERE for a full list of services offered

[/fusion_text][/fusion_builder_column_inner]

[fusion_builder_column_inner type=”1_2″ spacing=”yes” last=”yes” center_content=”no” hide_on_mobile=”no”]

[fusion_text]

Click image to View/Download Navwealth

Bookkeeping Resources Brochure

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner]

Neville Thompson, Jabiru Consulting

Below is further information and articles regarding Navwealth Bookkeeping. Our Director of Bookkeeping, Hayley Kalms and her team would love to discuss your bookkeeping needs.Please click on the link below to read the full article:

Meet Hayley Kalms – Director Navwealth Bookkeeping Resources

Bookkeeper vs Accountant – Do I need one, or both?

[/fusion_tab][/fusion_tabs][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]