Q2 2023 Financial Market Update

KEY POINTS

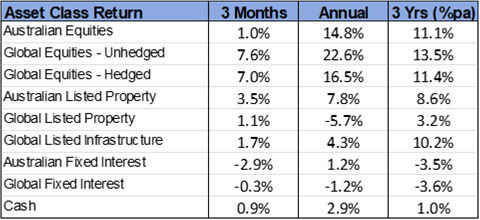

- A rally in global technology stocks lifted equity markets last quarter.

- With a low technology sector exposure, Australian equities underperformed global averages but remained in positive territory.

- Ongoing inflationary pressure led to higher bond yields and negative returns from fixed-interest assets.

![]() TECH SECTOR RALLY DEFIES WEAKER ECONOMY

TECH SECTOR RALLY DEFIES WEAKER ECONOMY

A significant but narrow rally in technology stocks was the main contributor to a strong rise on global equity markets last quarter. There was particular focus on those companies set to benefit from developments in artificial intelligence. Headlining these gains was Nvidia Corporation, which rallied 52% over the quarter following a well-received earnings revision.

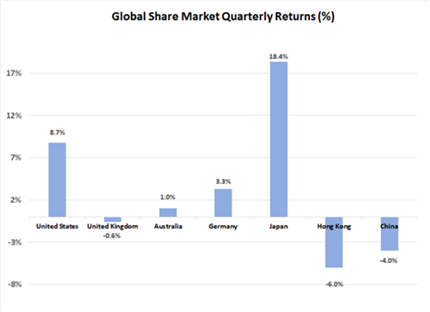

The tech rally had a more significant impact on the U.S. market, which gained 8.7% overall. The U.S. has a large holding of Information Technology stocks, which now make up some 28% of the S&P 500 Index. Within this index, the Information Technology sector rose 17.2% over the quarter, bringing the calendar year-to-date gain to 42.8%. Strength in the tech sector helped the U.S. share market successfully fend off two key challenges. Last quarter saw the re-emergence of regional banking sector concerns. In early May, the First Republic Bank became the second-largest U.S. bank failure ever, with the majority of its assets and operations being taken over by JP Morgan Chase. Despite the size of First Republic, its collapse was well-contained and did not trigger a wave of further deposit runs. Later in May, focus switched to the U.S. Government’s debt ceiling, with a deal eventually being reached between the two major parties in the House of Representatives. The deal will require that US$30 billion of additional spending cuts be made next financial year, which is equivalent to a modest 0.1% of GDP.

Outside of the U.S., share market gains were moderate, with the exception of Japan where the Nikkei Index jumped 18.4%. Share prices have reacted positively to the Tokyo Stock Exchange’s direct request to companies to improve return on capital. The initiative is expected to prompt share buybacks and other reforms aimed at improving shareholder returns. A weaker Yen over the quarter is likely to have also generated support for Japanese exporting firms. It was another disappointing quarter in China and Hong Kong, where the economic recovery continues to underwhelm previous expectations.

Global property & infrastructure underperformed the broader equity market last quarter, returning between 1% and 2%. These asset classes are likely to have been negatively impacted by rising bond yields, making rental and infrastructure yields less attractive on a relative basis. Concerns that tighter credit conditions in the U.S. banking sector will negatively affect property refinancing opportunities have also weighed heavily on the global listed property asset class over the past 6 months.

AUSTRALIAN SHARE MARKET STAYS IN POSITIVE TERRITORY

As was the case on global share markets, Information Technology was the standout sector in Australia last quarter, with a gain of 21.1%. Other sectors produced mixed results, with lower commodity prices negatively impacting the resources sector, which fell 1.8%.

Healthcare recorded the largest decline last quarter, although the majority of the 6.6% fall can be attributed to CSL, which fell sharply in June after announcing the impact of foreign currency movements on expected earnings.

There was also a notable weakening in sentiment around consumer stocks, with expectations firming that consumer spending will soften as financial conditions for households continue to tighten. These falls in consumer stocks came despite some limited and targeted household assistance measures announced in the Commonwealth Government Budget Statement in May.

INTEREST RATE RISES CONTINUE ACROSS THE YIELD CURVE

Short-term interest rates have continued to shift higher, with the Australian Reserve Bank delivering two 0.25% rate increases over the quarter to bring the cash interest rate to 4.10%. However, both the Australian RBA and the U.S. Federal Reserve have paused interest rate increases in their most recent meetings.

Nonetheless, the higher short-term interest rates and the ongoing persistency of inflation pushed bond yields higher over the quarter. In Australia, the 10-year Government bond yield rose from 3.3% to 4.0%, with the U.S. counterpart increasing from 3.5% to 3.8%.

Despite appreciating over the month of June, the Australian dollar finished the quarter lower, falling from U.S. 67.1 cents to U.S. 66.3 cents. Lower commodity prices and a weaker than expected Chinese economy could be contributing to weakness in the $A. The $A was also 0.9% lower against the Euro, but was 7.7% higher relative to a softer Japanese Yen.

CONSIDERATIONS FOR INVESTORS

The pattern of movement on share markets over recent months may reflect an attempt by investors to remain exposed to the asset class yet avoid the effects of the earnings downgrades associated with an inevitable slowdown in broader economic growth. Increasing support for information technology stocks is likely to reflect a view that these companies are somewhat immune to the current economic cycle, with the structural tailwinds behind earnings from technological advancement dwarfing the impact of any shorter-term cyclical weakness. It is not clear why the market has taken to this view so strongly in recent months when the same stocks were being sold-off heavily over the course of calendar 2022. Technology and its potential applications have not changed so materially over this period.

Whilst there is some logic in preferring companies with earnings less exposed to near-term economic weakness, a belief that the Information Technology sector is immune to the economic cycle is misguided. If households are consuming less and businesses investing and employing less, the demand for Information Technology services and products will undoubtedly contract.

As with nearly all sectors, the degree to which tech company earnings will be impacted by an economic downturn will be influenced by the severity and longevity of that downturn. Assessment of the seriousness of a downturn is often linked to whether a “recession” is deemed to have occurred. However, investor focus should not be too heavily concerned as to whether or not we are approaching a recession (technically defined as two consecutive periods of negative economic growth). In fact, on a per-person basis, Australia is probably already in recession. The March quarter National Accounts showed a contraction of 0.2% in economic activity per person and a result of this magnitude appears likely for the June quarter just passed. However, for equity investors, this fact may be largely irrelevant. As was demonstrated in the COVID crisis in 2020, share markets can “look through” shorter-term periods of earnings weakness. It is longer-term earnings that ultimately determine a company’s valuation.

Investor sentiment should, therefore, increasingly be focussed on assessing the longevity of the current period of elevated interest rates and associated economic downturn. The key variable in this assessment is the inflation rate, as central banks have been explicit in their commitment to maintain tight policy until inflation is back to acceptable levels. On this basis, the United States would appear closer to relief on interest rates than Australia. U.S. inflation has fallen steadily over recent months and at 4.0% is now materially below short-term interest rates. In contrast, Australia’s inflation (currently at 7.0%) could be more persistent given the nature of wage setting and the labour market here. This disparity in outlook may explain the more significant increase in bond yields that took place in Australia last quarter. As a result, bonds are now providing much fairer and more attractive compensation for the risks of holding longer-duration fixed-interest assets.

Due to the uncertainty over the future path of inflation and monetary policy, there are clearly risks in following the exuberant trend of recent movements in Information Technology stocks. Those investors buying tech stocks at current valuations may ultimately be proved correct – but their shorter-term success appears heavily dependent on an assumption of imminent victory in the fight against inflation.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).