Q1 2024 Financial Market Update

KEY POINTS

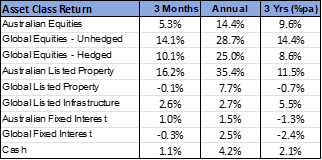

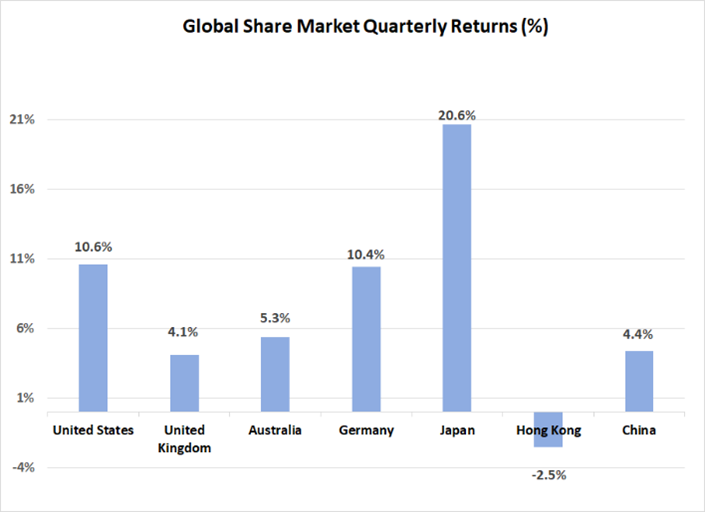

- The global equity rally continued over the March quarter, with positive earnings results in the U.S. technology sector being the main catalyst for continued price growth.

- Global bond yields inched higher as markets pushed back the expected timing of any interest rate cuts.

- Both global property and infrastructure significantly lagged the broader equity market.

![]() GLOBAL SHARE MARKET ADVANCE CONTINUES

GLOBAL SHARE MARKET ADVANCE CONTINUES

Global share markets built on the strong gains from the final two months of 2023, with an average increase of 10.1% recorded over the March quarter. New record highs were set in several markets, with the average annual gain in the asset class now 25.0%. A favourable profit reporting season buoyed investor confidence, which was particularly the case in the large U.S. Technology sector where share valuations advanced 13.4%.

Japan was also a standout, with the Nikkei Index rallying 20.6%. Support for the Japanese market was buoyed by a weaker Yen, as well as further evidence that Japanese companies were taking action to improve return on equity, primarily via share buybacks.

In a turnaround from recent months, there was a sharp bounce higher on the Chinese market over February and March, with Chinese shares 4.4% higher for the quarter. Both the share market and the broader Chinese economy may have now passed the bottom of recent downturns, and the relatively cheap valuations on the Chinese equity market have been attracting some buying support. On an annual basis, the Chinese equity market remains in negative territory by 9.4%, with Hong Kong 15.7% lower. Outside of China, other emerging markets lagged the heady returns of developed markets last quarter. India (up 6.2%) and South Korea (up 5.2%) both underperformed the broader global average, as did Brazil (down 5.7%), which was impacted by the lower iron ore price. Taiwan, however, was an exception, with its technology orientation contributing to a 15.7% gain.

A small lift in longer-term global interest rates over the first two months of the quarter detracted support for global property and infrastructure. In fact, global listed property finished the month in negative territory at -0.1%, with listed infrastructure mildly positive at 2.6%.

Although the March quarter continued to be dominated by technology and “growth” styled equities, there was some turnaround in this trend in the final month of the quarter. During the month of March, the more “value” orientated sectors performed better, with property, resources and energy rallying. Smaller companies also outperformed larger companies in March, which was a reversal of the dominant trend of the past year.

AUSTRALIAN SHARES IMPACTED BY LOWER IRON ORE PRICE

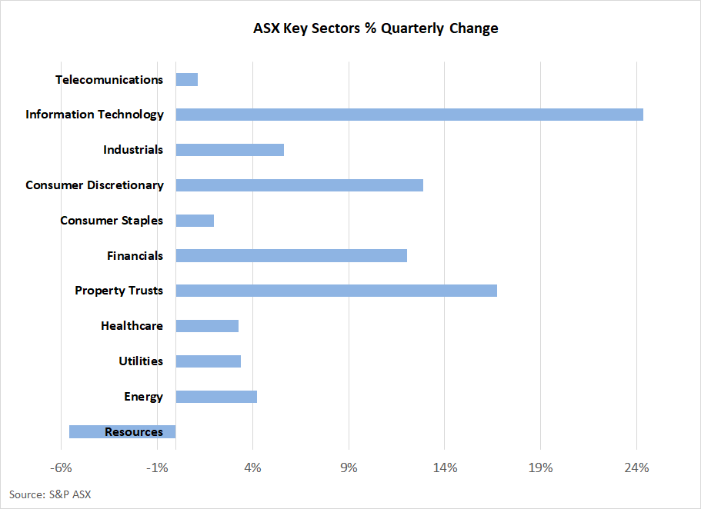

The Australian share market underperformed, with the S&P ASX 200 Index rising by 5.3%, which was just over half the global average last quarter. The local market was weighed down by the resources sector, which declined by 5.6%. Of significance was a decline in the iron ore price of 28% from the high reached at the end of last year. The weaker iron ore price saw falls in the price of BHP (down 10.0%) and Rio Tinto (down 7.3%).

Consistent with the broader global trend, the Information Technology sector was the best performed on the Australian market last quarter with a surge of 24.4%. Listed property (up 16.2%) was also a standout and was again boosted by Goodman Group, which rallied 33.6% over the March quarter. Assisted by a positive outlook for data centre demand, Goodman has increased by 82.4% over the past year and now represents 35% of the value of the S&P/ASX 300 A-REIT Index.

AUSTRALIAN YIELDS STUDY

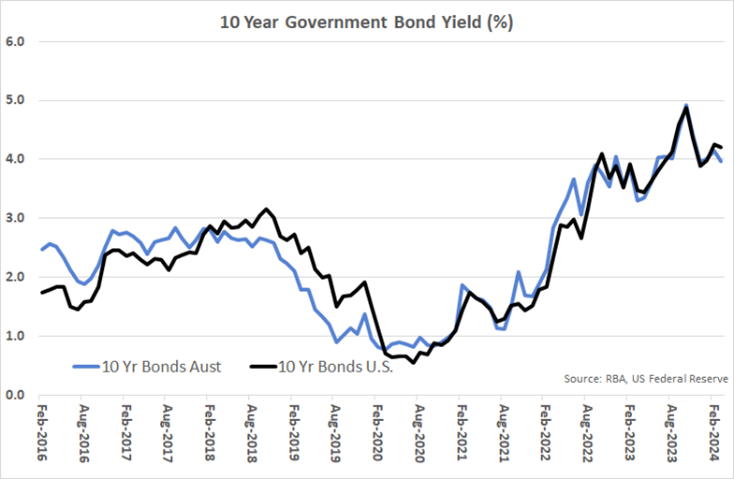

There were some minor changes in monetary policy settings during the quarter, with the Swiss central bank lowering interest rates by 0.25% and the Bank of Japan increasing its policy rate to just above zero in March. However, policy settings in Australia and the United States remained unchanged.

The Minutes of the Australian Reserve Bank’s March meeting did indicate a slight change in tone that possibly suggests a greater willingness to lower interest rates should inflation continue to decline.

However, there was an increase global longer term yields last quarter with the U.S.10-year Treasury Bond yield moving from 3.88% to 4.21%. This increase is likely to reflect money markets pushing back expectations around the timing and magnitude of U.S. interest rate cuts because of some slightly higher inflation results in the United States. In contrast, the Australian 10-year government bond yield remained unchanged at 3.96%. The 0.25% margin between the U.S. and Australian 10-year yields is the largest recorded on a month end basis since October 2022 and is indicative of the weaker economic growth outlook for Australia.

After strengthening towards the end of 2023, the $A returned to a declining trend over the March quarter, falling from U.S. 68.4 cents to 65.3 cents. Weaker iron ore prices and a stronger $US contributed to the lower the lower $A. The $A was also 2.4% weaker against the Euro but moved 2.2% higher against a softening Japanese Yen.

CONSIDERATIONS FOR INVESTORS

The rally across global equity markets in the March quarter was noteworthy given that it followed such a substantial increase in the final two months of last year. Five consecutive monthly increases on global equity markets have resulted in valuations advancing a significant 23.6%. The justification for an increase of this magnitude is twofold. Firstly, there was clear evidence that inflation was being brought under control, which allowed the U.S. Federal Reserve to indicate that interest rates would fall this year without the U.S. economy having to experience a significant downturn or recession. Secondly, company earnings have been healthy, particularly in the U.S. technology sector, with the promise that significant advances in Artificial Intelligence (AI) could provide a springboard for further structural improvements in profitability, productivity and ultimately living standards.

A key feature of the equity market rally over recent months has been its narrowness. Technology stocks inside the U.S. S&P 100 Index gained 31.6% since the start of November and are nearly 50% ahead for the past year. This is approximately double the annual gain in the global equity market as a whole. No doubt some of this disproportionate increase can be explained by the favourable profit results announced by companies in this sector, and the fact that many are well positioned to benefit from AI. However, history does suggest that financial markets can “over extrapolate” new information and operate with “irrational exuberance”. Only time will tell whether or not now is one of those occasions.

Given the valuation risks that have potentially emerged in the technology sector, the change in the pattern of price growth evident in the final month of the March quarter was welcome. Areas of the market that had been ignored for much of the past year, such as infrastructure, smaller companies and property (where Goodman has been one of the few property companies globally to attract any positive sentiment) showed strong buying support and outperformance. This more balanced pattern of price movement, though, could be a sign that the equity rally is reaching a mature phase of the cycle whereby investors are being forced to look wide and hard for the remaining pockets of value.

The other welcome development that has emerged more recently has been a rebound in the Chinese equity market. Whilst still well off its past highs, two consecutive months of price growth may play an important role in restoring confidence to Chinese financial markets and businesses. Economic data in China is showing some sign of improvement, with the release of monthly manufacturing activity last month confirming the first monthly increase for 5 months. As the world’s second largest economy, the significance of any improvement in Chinese economic growth should not be understated.

Due to the magnitude of the rally that has taken place in the U.S. technology sector over the past year, many investment portfolios would be heavily weighted to a relatively small number of companies in this sector simply because of market movements. Similarly, exposure to the US currency may also be extended. Because of the narrowness of the equity market rally, deliberate actions to diversify into areas such as infrastructure, emerging markets and mid to smaller companies are now more important than ever. The month of March, whereby market leadership was provided by sectors other than Information Technology, may not be a short-term aberration.

Important Information

The following indexes are used to report asset class performance: ASX S&P 200 Index, MSCI World Index ex Australia net AUD TR (composite of 50% hedged and 50% unhedged), FTSE EPRA/NAREIT Developed REITs Index Net TRI AUD Hedged, Bloomberg AusBond Composite 0 Yr Index, Barclays Global Aggregate ($A Hedged), Bloomberg AusBond Bank Bill Index, S&P ASX 300 A-REIT (Sector) TR Index AUD, S&P Global Infrastructure NR Index (AUD Hedged).